Having read about this exciting contest in January this year and listened to the master track, I downloaded the individual stems and decided to see what we could make of Destiny’s Door by Hans Zimmer for the Bleeding Fingers competition. So many talented composers and producers entered this contest and I felt lucky to be arranging, mixing and producing some of Hans Zimmer’s music. I decided to keep the favourite sounding tracks of brass, winds and added a choir and other sounds and hoped to create a heavenly and mystical feel for our version. It was a great experience and although we didn't win, we received some really great comments and feedback on our version, "Sunrise" which we arranged and produced for the contest. Many congratulations to the winners and you can hear their entries here.

0 Comments

I wrote here in January 2011 about the banking crisis in the UK and also about the way certain banks have been run for their executives and not their shareholders. - See blog post here.  Since then Barclay's share price has risen little, still not delivering great returns for their shareholders and today they announced a half-year adjusted profit before tax fall 17% year-on-year to £3.59bn; despite this they are spending £510m on bonuses. They are also planning to issue £5.8bn in new shares as part of a move to plug the £12.8bn capital shortfall created by new regulatory demands and on this news their shares fell again sharply. They are having to do this after the banking regulator - the PRA (Prudential Regulation Authority) issued tough new capital requirements at the banks, requiring them to have a 3% minimum ratio of capital compared to the amount of capital they hold.

So who is going to buy these shares in this "great investment" opportunity? I doubt there will be few takers from the retail investors and I certainly won't be adding them to my SIPP; it will be the institution pension funds that will suck them up, as they are the only investors who would be able to justify buying them. Now guess what effect that is going to have on all our pension pots? Is it going to provide them with larger or smaller returns?  The Baddies? So, the press have done with bashing the bankers for now and need to find another target for populist support...all those “big bad” corporations and companies not paying their taxes?

The politicians last week at the G8 decided to make themselves look good and try to curry favour with their voters by distracting from the really important issue of trying to drag us back to economic growth after the worst recession for a generation. There was a lot of tough talking about Trade, Tax and Transparency but what did it achieve? While Margaret Hodge is wasting time, money and oxygen in parliamentary select committees interrogating and vilifying some of the worlds greatest companies and employers such as Google, Amazon, Apple, Starbucks etc, she is entirely missing the point. These “big bad” corporations, unlike MP's and politicians, create employment and hence wealth and provide products and services that we, the customer love to buy and use. These companies have to pay all the taxes they are legally obliged to as none of them would operate on the wrong side of the law. They have a duty to their shareholders to minimize all their costs, including tax so they can maximize profits to generate investment for more growth and employment. So what exactly then are they being accused of? It is the government and politicians that make the rules and decide on the appropriate levels of taxation; the corporations in turn play the game, and pay what they have to, and surprise surprise, no more. Government clearly needs to change the UK tax laws to reflect the new digital world we all live and work in especially as most of these companies trade internationally but this takes time and is complex to achieve. However there could be an easier way to kill two or three birds with one stone. Maybe if governments become competitive as corporations have to be, they would become financially more successful? Surely then here is the answer.....rather than sniping at the corporations, the government should do something positive to attract them to the UK, so why not start by reducing the UK’s corporation tax so that it competes with the 12.5% rate of Ireland and what would then happen? Our unemployment would be reduced, tax receipts would increase, the deficit would be reduced and growth would return. Now that really that can't be to difficult to do, can it?  I have been thinking recently about all the taxes UK citizens and companies have to pay to live and work in this country and thought it would be a good idea to list them here, so here goes - Hope I have not missed any! Income

National Insurance Alcohol and tobacco Council tax VAT - why add this to energy bills? Road fund Fuel duty - on petrol & derv - why so high as oil companies already taxed? Air Passenger Duty - APD & other aviation taxes Carbon tax - another one on energy bills! Stamp duty - shares and house (wonder why the housing market is sluggish!) Capital gains Corporation Employers NIC Business rates Class 1a NIC ...and finally when we die....Inheritance (but only 3% of estates large enough for this) Tax Freedom Day, the first day we get to keep our earnings in the year is 30th May for 2013, and we will see how that changes for 2014. Now I have listed them I can start to compare these to other countries to help decide where I want to retire to!  The idea of having an Electric Vehicle (EV) as a second car came when my wife started talking about getting a small "green" second car as a run-a-round, with good MPG for school and station runs. With ever increasing fuel costs, this seemed a good idea but we also needed it to be able to cope with our weekly animal feed runs of corn, pellets, goat mix, hay and straw bails! So we looked at what our average mileage would be in the second car and calculated that during term time this would be between 40-50 miles a day. It then occurred to us that if we were going to get a "green" second car, why not go for one with the lowest emission possible? That meant looking at Electric cars. As we live in the middle of the Kent countryside, the thought of a EV vehicle had not even crossed our minds as we are far from being the typical type customer.  We first looked at the Mitsubishi i-MiEV and the rest of the family thought I was joking when I suggested when one day when in Eastbourne, of booking a test drive. We took the car out two of us at a time with the salesman, and I was pleased to see the big smile on my wife's face as she and our daughter climbed out after the first test drive. After my son I returned from our drive we all agreed how fun, quite and enjoyable it was to drive and realized that an electric car would work for us. Having now driven our first electric car, we thought we better take a look at another model to compare and started to see what else there was on the market, closer to home. Whilst the i-MiEV is a great little car, the Nissan Leaf has far more room for our animal feeds, and is better equipped, including rear parking camera, so the decision on which to go for was an easy one to make. So having driven nearly 1,100 miles in our first month we are so far very pleased with the Leaf which has performed as well as we had expected. Also pleased to see the Nissan Leaf in the new Apple iPhone 4s siri video - see it here.  Well we finally got there, and took delivery of our first all Electric Vehicle (EV) on Tuesday the 13th this week with our fingers crossed! It was only a couple of weeks ago we took the plunge and placed our order, and before we knew it, we were driving our new Nissan Leaf away from the dealers forecourt off into the real world. Having lived with the car for a few days now, I thought it a good idea to write a few lines about our first experiences with it. We had researched the the Nissan Leaf fairly well and are pleased to say that, so far we have had no surprises. We just drive it during the day, shuttling from home, to work, to school, to the station, plug it in at night into a standard 13amp domestic socket, and by the morning it is fully charged, ready for use again at the cost of approximately £1.50 - It will even email you to remind you to plug it in should you forget! The 90 miles fully charged range works well for us as our daily mileage is roughly 40 miles, and needless to say, the zero emissions and zero rated Road Fund licence are a real plus.  Fully charged with 98 miles and ready to go!  In addition to that, it's very comfortable, and very quiet, almost silent inside. This all helps to make it the most relaxing car we have ever driven and somehow it always makes you feel very happy driving it. We were surprised that people seem to know very little generally about EV's, and one of our friends was even surprised to find that it not only had a heater, but also full climate control! The reaction from most people when seeing it is usually amazement, that it is powered only by batteries, and not some kind of hybrid. Also, just how like a "normal" car it is and when taking them for a drive, how unlike a milk float it is! So, the only time we stop at a petrol station now with the Leaf is to grab a paper, or pick up a sandwich for lunch! To be continued... So what is the British Government up to now with the creation of these new Enterprise Zones?

Anything that can be done by Government to stimulate economic growth in the UK has to be a good thing, but why do it selectively by creating "government helped" and "government not helped" regions? Surely it would be more effective to offer all businesses in the UK where ever they are based, incentives by means of reduced taxes and red tape; this is what is really needed, not an artificial stimulus. I thought that they would have learnt a thing or two by now as these Enterprise Zones did not work in the 1980's so I do not know why they think they should work in 2011. Government really needs to learn to stop meddling in businesses and leave the entrepreneurs who create employment and the wealth of this country to run themselves. All these will do is create a false economy by moving jobs away from the 'no help" to the "have help" regions. Now thats hardly fair is it? See here for the details in full - http://www.bbc.co.uk/news/uk-england-14552193  Well, I received an invite to this several weeks ago and accepted it the same day. Since then it's been great fun and I have met & Hungout with many new people, as well as re-establishing links with old friends. Many people are talking about it replacing Facebook and Twitter, but I will still be Tweeting, and I do not know about Facebook as I have never done it! If you would like to join and do not have an invite, drop me an email as I have a few invites left, otherwise see me at :- david2knight The European Court of Justice ruling this week in Luxembourg on sex discrimination seems to have gone a step too far and mixed up basic business calculations with risk and equality.

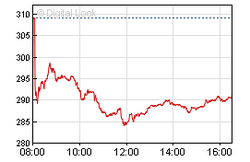

Insurance companies have been using statistics and facts to price their premiums to provide car insurance and pensions, but now will not be able to as this has been ruled out as sex discrimination. This ruling will come into force from December 2012 and will mean a rise in cost of approximately 25% of the premiums women pay for car insurance, with some reduction for men. It will also mean a rise in the cost of pensions for men. I also suspect that insurance companies will use it as a great excuse to increase their margins. What is going on here? The facts are …men DO live longer than women on average, and women also are LESS likely to be involved in accidents, so being a lower risk. So why is a business now stopped from using facts about risk to calculate a business charge? Also, what about age discrimination? What are they going to do about the "discrimination" that exists between young drivers paying higher rates for their premiums than the older drivers? Surely they should be paying the same? Pricing should be based on total risk to the insurer, not some miss placed discrimination view of a European bureaucrat. It has nothing to do with discrimination over race, age, sex or even shoe size! This is a perfect example of the European bureaucrats trying to find something to do to justify their expenses and huge salaries paid for by the tax payer and nothing to do with common sense! It looks as though up to 25% of new trainee pilots in the RAF are going to be told that their training is to be terminated on Tuesday, as part of the Government strategic defence review. They will have been training for the last few years to fly fighters, helicopters and transport aircraft. So the money that has been spent on this will be wasted, about £4 million for each pilot, plus the cost of the redundancies; what a waste of our tax payers money! As the UK is an island the Royal Air force has to be the most important of all our defence forces as proven by history; what a sort memory our government seem to have! How can we then support the front line forces in Afghanistan or any other global conflict the UK decides to help with?  After the coalition government's promise of “robust action” and the business secretary Vince Cable's tough talking, I thought there would finally be some action to curb the ridiculous levels of pay and bonus that banks pay their executives. I suspect that most people find this practice obscene and unacceptable, especially as we are just about to start feeling the full force of the cuts and tax increases that the Chancellor George Osborne has had to make following the near crisis caused by Gordon Brown's lack of regulator control with the banks. However, it seems that the government has just backed down from this idea and so therefore we are not "all in this together" after all, and the only thing the bankers are in is the clover! So why do we only see the newspaper easy headlines bashing the bankers and why don't shareholders or fund managers join in this debate? Some might argue that it is necessary to pay these bonuses to keep the "high flyers" in the UK for their successful performance; but if we look at Barclays Bank LSE: BARC for example, who's new CEO, Bob Diamond spoke at the treasury select committee this week, their share price and market capitalisation is now lower than in was 5 years ago. How can this be when they have many "high flyers" working for them? Is it because the banks, public companies responsible to their shareholders, have been paying huge bonuses which leave not enough retained profit at the year end to distribute to their shareholders. The “high flyers” are clearly not adding value to the bank, just lining their pockets and sucking out all the value of the business for themselves with these bonuses. So who is running who? Are the banks being run to add value to the business for their shareholders or are the executives running the banks to simply pay for their bonuses. Surely the “high flying” executives can’t be doing their jobs properly if this what the most "talented" of them are doing. If they were on a performance related bonus, they clearly would be not be getting a bonus as the results they produce are so poor. I think their employment contracts need a serious review, especial for those banks where the tax payer virtually owners them, such as with Royal Bank of Scotland LSE: RBS and Lloyds Banking group LSE: LLOY So how have other FTSE 100 companies performed in the same period? Take the five years share price BG group (BG.) Their share price has doubled in 5 years, without the UK tax payer forking out a penny to help them and this is the other point. Banks are fundamentally a different kind of business to any other, as they underwritten by the British taxpayer and are not allowed to fail, so therefore they should be regulated very differently to other PLC’s. They are also not doing the job they are supposed to be i.e. lending money. I am sure they would argue that they are lending to businesses, credit cards etc, but their loans are not being taken up because the rates they are quoting are not realistic. The bank base rate is the lowest it has been for many years, but they are charging rates of 9-12%. You really do not have to be that clever to borrow money at 0.5% and then lend it at these rates, with free insurance paid for by the UK tax payer, covering you just in case you can’t make money from this! Could it even be argued that bankers are actually trying to destroy capitalism? Having helped caused the the credit crunch and the near collapse of the banking system they then go on to provide little return for the shareholders. If BG group can return that kind of performance for it’s shareholders, it shows there are plenty of really “high flyers” out there and I bet they do not receive the kind of bonus the bankers do. Just a shame they do not work at a bank. So who then has added the most value for shareholders and is doing the best job, and should receive the biggest bonuses? I'll let you work that one out! With thanks to digitallook.com for the information. This month there was a reunion for old pupils of The Wildernesse School, Sevenoaks. I was a pupil there from 1965 - 1975 and it was great to see so many old faces, and some of the teachers looked the same as they did 35 years ago!  Our 6th form class with teacher, Mr Ken Fisher Our 6th form class with teacher, Mr Ken Fisher I have put a link here to see some more photos showing our class.

|

AuthorThis is the Blog of David Knight with updates on EnigmaSounds & also some hopefully amusing, informed comments with the occasional rant and rave about this crazy world we all live on. My old archived blog can still be found at - http/david2knight.wordpress.com Categories

All

Archives

July 2014

|

RSS Feed

RSS Feed