|

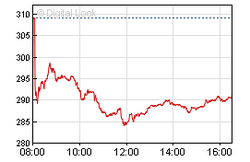

I wrote here in January 2011 about the banking crisis in the UK and also about the way certain banks have been run for their executives and not their shareholders. - See blog post here.  Since then Barclay's share price has risen little, still not delivering great returns for their shareholders and today they announced a half-year adjusted profit before tax fall 17% year-on-year to £3.59bn; despite this they are spending £510m on bonuses. They are also planning to issue £5.8bn in new shares as part of a move to plug the £12.8bn capital shortfall created by new regulatory demands and on this news their shares fell again sharply. They are having to do this after the banking regulator - the PRA (Prudential Regulation Authority) issued tough new capital requirements at the banks, requiring them to have a 3% minimum ratio of capital compared to the amount of capital they hold.

So who is going to buy these shares in this "great investment" opportunity? I doubt there will be few takers from the retail investors and I certainly won't be adding them to my SIPP; it will be the institution pension funds that will suck them up, as they are the only investors who would be able to justify buying them. Now guess what effect that is going to have on all our pension pots? Is it going to provide them with larger or smaller returns?

0 Comments

|

AuthorThis is the Blog of David Knight with updates on EnigmaSounds & also some hopefully amusing, informed comments with the occasional rant and rave about this crazy world we all live on. My old archived blog can still be found at - http/david2knight.wordpress.com Categories

All

Archives

July 2014

|

RSS Feed

RSS Feed